Financial stress is known for having a negative impact on employee productivity, engagement, and mental health. In fact, 86% of employers themselves characterized financial wellness programs as being important. Now, more than ever, employees are looking to employers for financial help in some of these various forms:

- Financial education

- Student loan forgiveness

- Employer-sponsored loans

- Early advance pay

While employees need this assistance, few employers offer adequate help. For employees who have a less than perfect credit score, they are bound to look for financial help from any source, so long as they are willing to help. This can lead to things such as predatory lending, which is a bad cycle that anyone can fall victim to. With that in mind, offering an employer-sponsored no credit check loan program as a voluntary benefit to your employees can have many benefits for your employees and your organization’s ROI.

No Credit Check Loans

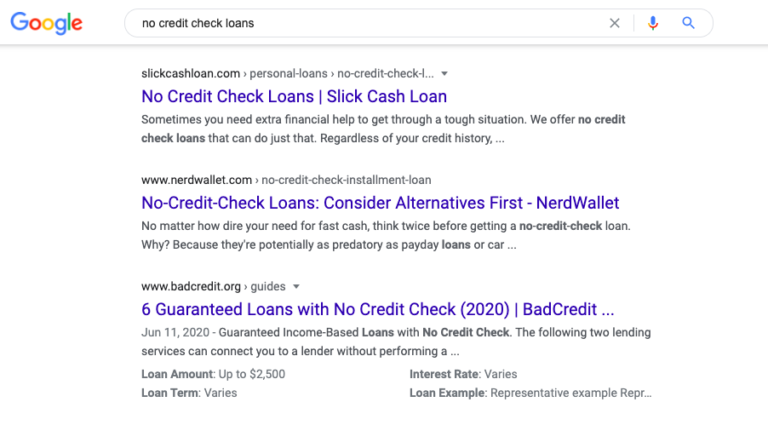

Before actually diving into some of the most prominent reasons why you should offer your employees a no credit check loan program, it’s important to understand the tricky world of no credit check loans. Loans that do not require credit checks sound shady and, for the most part, they are shady! A quick Google search for “no credit check loans” yields the following results at the top of the page:

Talk about shady…

However, for any employee who is stressed about their finances and has a sub-par credit score, these options may be appealing. Taking out a loan through a payday lender, which is what most no credit check loans are, is a negative spiral that can leave your employees in debt.

“That’s Why We Offer Financial Education and Consulting”

Yes, financial education and consulting is so important to help your employees learn to break the cycle, but before they can implement these learnings, they need a solution for cash and they need it now. Offering the above-listed items may benefit your employees, but they all fall short of helping your employees as much as an employer-sponsored loan program would. Reversing the negative cycle of debt and bills piling up starts with a loan, but it should come from a trusted source that isn’t predatory and doesn’t leave your employees with more financial stress than they started with.

The Real Truth About Employee Debt

Did you know that the majority of employees are unprepared for unexpected financial burdens? In fact, pre-pandemic, it was reported that more than ⅓ of full-time employed Millennials, Gen Xers, and Baby Boomers had less than $1,000 saved in the event of unexpected expenses.

This effect has only been made worse by the pandemic, and as many as 46% of workers have reported being “extremely” or “moderately” concerned about their household income amidst these troubling times. Personal finances are one of the leading causes of stress among employees. In fact, roughly 11% of Americans have a credit score below 550, and another 20% have a credit score that is considered “subpar”, being in the range of 580 to 669. That’s 1/3 of your employees struggling with financial stress.

Below are just three of many fantastic reasons why you should offer your employees an online no credit check loan program.

Engaged Employees

A recent PwC survey discovered that employees tend to cite financial matters as the biggest life stressor above all else, with 50% of those polled saying financial troubles have distracted them at work. Credit check loans are great options for anyone who has a good credit score, but the majority of the population may not have good enough credit to secure those loans. By providing a no credit check loan option, you can remove the financial stress from your employee’s minds and help them to be more engaged on the job.

Predictable Workforce

Some reports found that nearly 50% of respondents were more committed to staying with their current employer for a longer period of time if financial wellness benefits were offered. Each year, it seems the cost of living expenses, unbudgeted expenses, childcare, and healthcare get more expensive. Salaries can only be increased by so much, but adding a no credit check loan option to your company shows employees that you care about them and their wellbeing keeping them employed at your organization longer.

Better Benefit Usage

Increasing participation in your 401(k)/403(b)s, 529s, deferred compensation plans, high-deductible healthcare plans are only really options for those who have the means. Yes, these are all financial wellness programs, but they cater to a certain subset of financial stable employees. What about those who aren’t yet financially stable?

Employees will not participate in these benefits programs if they need every last dime of their savings to buy the necessities they need to survive. By providing a financial wellness program that offers a no credit check loan, you can bridge the gap to long-term benefit usage across all of your employee’s options.

To learn more about our patented financial wellness program with no credit check loans that cost employers nothing to implement and manage, contact TrueConnect today.