Guest post by Nick Rubright, Digital Marketing Specialist and expert writer at Mvix.

Major economic upheavals have caused serious problems for many people’s finances. The pandemic only served to compound things, with many markets becoming increasingly volatile for the average consumer.

If you’re like many individuals, you may be wondering where your paycheck has gone, month after month.

To shed some light on why your paycheck may not be going as far as it used to, let’s take a look at some vital personal finance stats for 2022.

General Income-Related Personal Finance Statistics

The pandemic brought about a period of income instability in the vast majority of U.S. households.

Here are some important post-pandemic personal finance stats related to yearly income:

- The average yearly personal income in the U.S. is $63,214. (Zippia, 2022)

- The median household income in the U.S. is $61,937. (Zippia, 2022)

- The median general income (for the general population) in the U.S. is $44,225. (Zippia, 2022)

- Approximately 15% of U.S. adults with an income under $50,000 used most of their credit on housing-related expenses. (Federal Reserve, 2021)

- In the same income range, 27% of parents struggled with their bills due to income variability. (Federal Reserve, 2021)

Income uncertainty can also result in a lack of an emergency fund maintained by low-income families. This further elevates the need for multiple income sources.

The situation is compounded when you consider that most employees had little to no safety net when the pandemic hit in 2020.

Luckily, many companies implemented financial, mental, and physical workplace wellness initiatives and extended paid time off to help mitigate the effects of the pandemic on financial security.

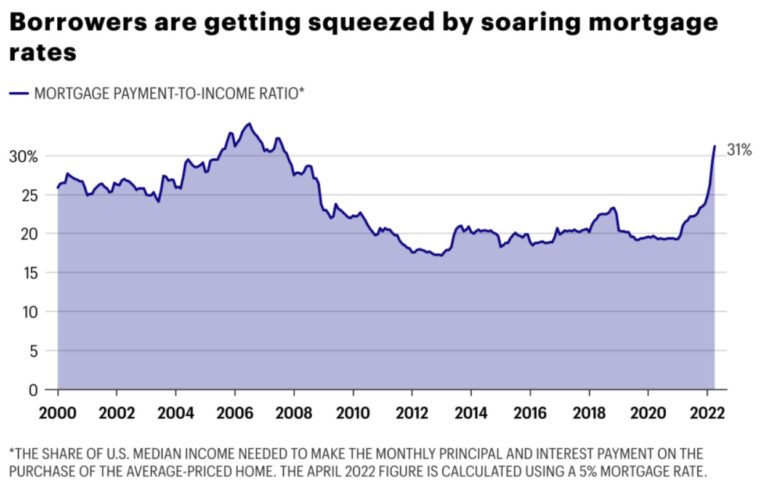

Mortgage and Home Ownership-Related Personal Finance Statistics

The ongoing trends in the larger housing market are a great indicator of what current and future homeowners can look forward to in terms of personal finances.

Here are the top mortgage and home ownership-related personal finance stats:

- The median sale price of a single-family home in the U.S. is $391,200 as of April 2022. (Statista, 2022)

- The sale price of single-family homes is currently at a record high, after a steady climb since 2011. (Statista, 2022)

- The current outstanding mortgage debt in the U.S. is around $18 trillion. This is up from $16.8 trillion in 2020. (Statista, 2021)

- The median rent crossed the $2,000 mark for the first time in May 2022. (Redfin, 2022)

- 2022 saw rent hikes of 3.7% from 2021, amounting to an average of $962 a month. (RealEstateSwitch, 2022)

Aside from the higher rent and increase in sales prices of individual properties, the housing market saw a general shortage of homes for sale.

This was attributed to a number of factors, including private investors and businesses buying up available properties. Solo renters and small families also reported being continually outbid for rental properties despite being extra conservative with their finances.

Real Wage-Related Personal Finance Statistics

In the past, there have been sweeping estimates made in the name of defining an exact average household income.

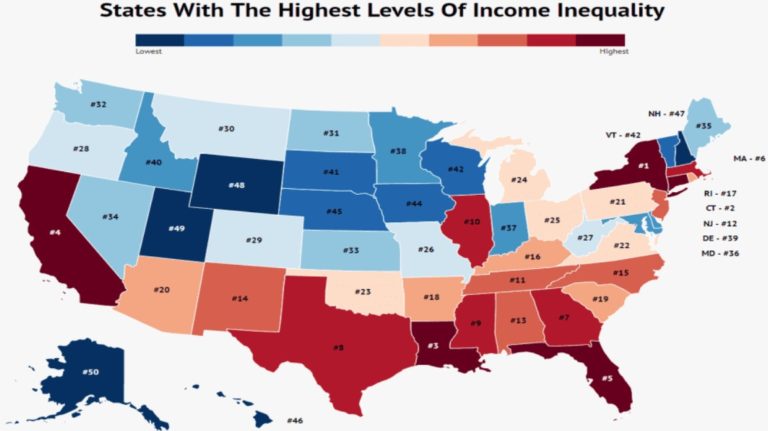

However, the current state of the economy and income inequality dictate that there cannot be an accurate number since income varies by age, gender, race, and several other factors.

To that end, here are the most important income-related stats for 2022:

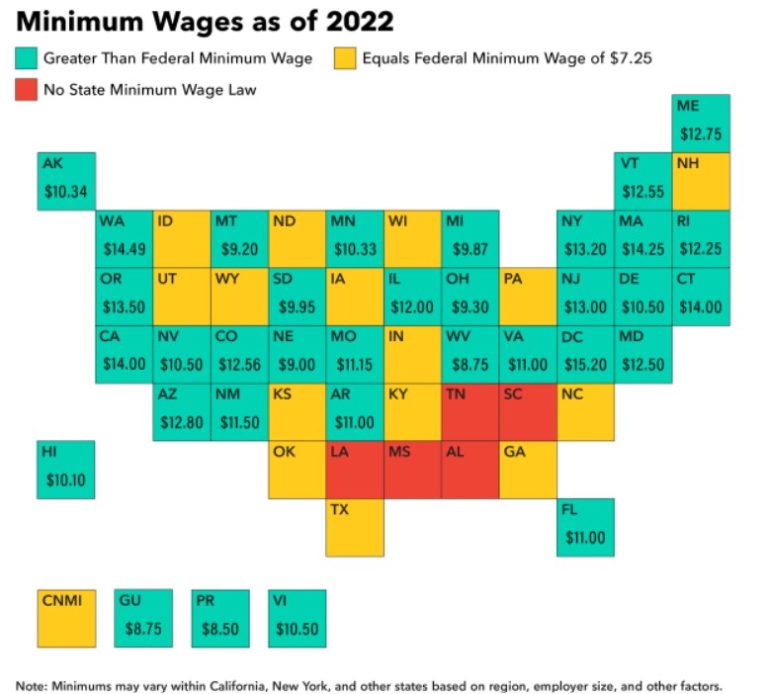

- The real wage in the U.S. only increased by $2.38 from 1964 to 2018. (Zippia, 2020)

- The average hourly (real wage) earnings are $10.97, as of May 2022. (Bureau of Labor Statistics, 2022)

- The average hourly earnings saw a drop of 2.5% from May 2021 to May 2022. (BLS, 2022)

- The average weekly (real wage) earnings are $379.53, as of May 2022. (BLS, 2022)

- The average weekly earnings saw a drop of 4% from May 2021 to May 2022. (BLS, 2022)

The decrease in real earnings can be attributed to an increase in labor outsourcing, caps on wage increases on both the state and federal level, as well as lower union memberships.

Additional Personal Finance Statistics for 2022

Despite the economy stabilizing in the aftermath of the pandemic, the majority of Americans continue to face economic hardship in one form or the other.

Here are some additional personal finance statistics that show the current situation for the average American.

- Around 58% of Americans live paycheck to paycheck in 2022. (PYMNTS & LendingClub, 2022)

- Approximately 157 million U.S. adults make up the 58% who live paycheck to paycheck. (PYMNTS & LendingClub, 2022)

- 30% of people living paycheck to paycheck make $250,000 or more. (CNBC, 2022)

- In 2022, approximately 56% of Americans would be unable to cover emergency expenses of $1,000 or more. (CNBC, 2022)

- Current consumer prices in the U.S. are up 8.6% as a result of inflation. (BLS, 2022)

Back in 2017, one in 10 people making six figures and over were living paycheck to paycheck. As we can see from the aforementioned stats, the situation has gotten progressively worse, even for relatively wealthier folks.

Considering the relatively bleak situation faced by most Americans, it makes all the more sense to start investing time and effort into improving your personal finances.

Final Thoughts

It’s never been more clear that efficiently managing personal finance is essential. If 2020 and 2021 taught us one thing about the coming financial climate in the U.S., it was that personal finances need to be managed on the individual level for there to be any kind of stability.

That said, as an employer you can definitely help improve the personal finances of your employees. And these contributions don’t have to take the form of outright monetary compensation.

A robust financial wellness platform can be a tremendous help to employees who need a helping hand. Not only can it help employees manage their time better and be more productive, but it can work as a powerful employee engagement tool as well.

Engagement is good not only for the employees, but also for your company’s bottom line. Dissatisfied employees cost U.S. companies an estimated $550 billion annually.

To learn more about TrueConnect’s Financial Wellness Platform, with access to financial advisors, emergency savings plans, and loan options, click here.